Comments: expert of the Center, Kravchenko L.I.

The outgoing 2013 can be called both a year of missed opportunities and a year of poor stability. It will go down in history textbooks as a period of stagnation, unfulfilled May decrees of the President, constant reductions in economic development forecasts, recognition of internal problems in the economy, forcing lending to individuals, reorganization of the banking sector, but at the same time the year of overcoming the natural decline in the population. In the outgoing year, the main vectors for the development of the coming years were set: deoffshorization of the Russian economy, investment in large infrastructure projects from the National Wealth Fund and the next development of Siberia and the Far East.

Year of stagnation

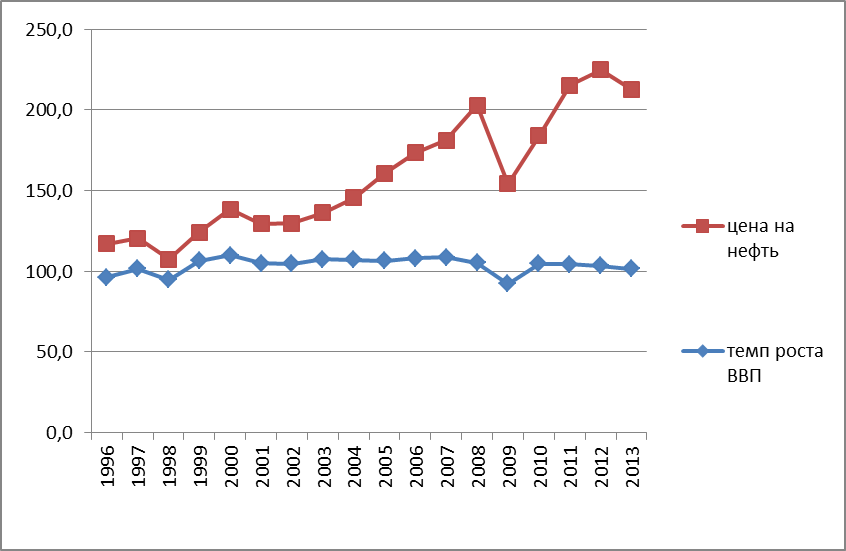

Russia has slowed down the pace of economic growth: in 2013 it was the lowest since the financial and economic crisis 2009 and 1998, reaching the level of 1997 - 1.4%.

Rice. 1. GDP growth rates, in %

For the first time, the President acknowledged that the causes of the crisis were internal problems, namely disproportions in the development of certain sectors of the economy, focus on the extractive industry, low labor productivity, lack of investment.

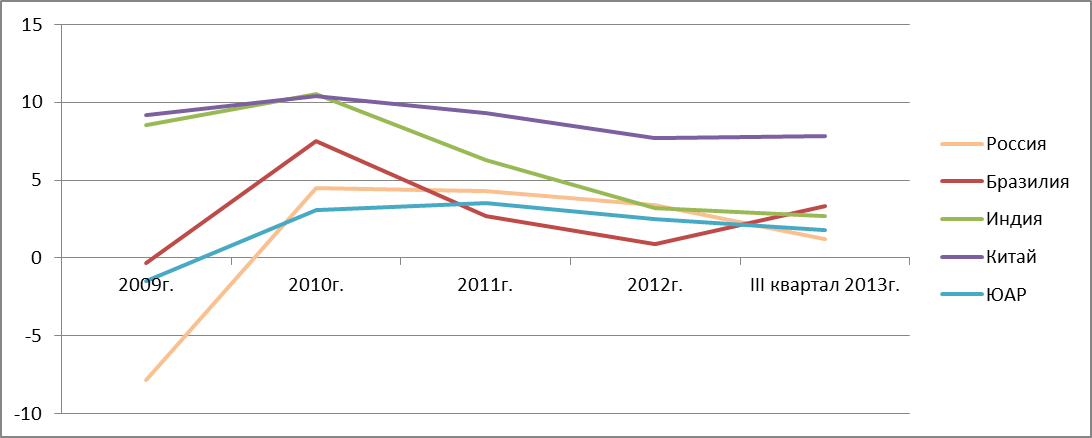

In terms of GDP growth, Russia is significantly inferior to its BRICS partners: for example, in China, Brazil and India, it amounted to 7.8%, 3.3% and 2.7% respectively (in Russia - 1.2%). Of the states in this group, Russia not only endured the crisis of 2009 worst of all, but also does not show any improvement trends in the future.

Fig.2. GDP growth rates of the BRICS member countries, in %

The Russian economy is not yet in a crisis, it is in a state of stagnation, from which, in the absence of structural changes necessary for the country, it is not far from a crisis.

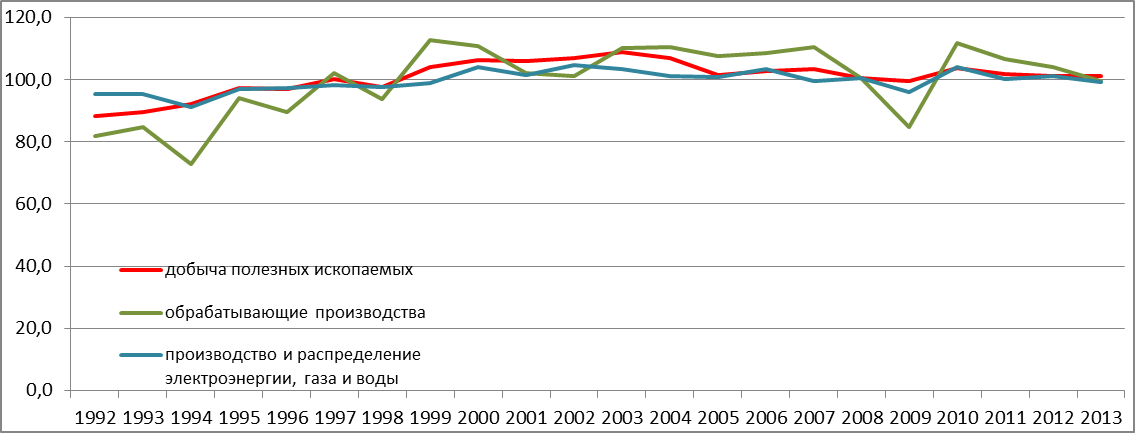

The index of industrial production this year fell from 102.6 (indicator of 2012) to 99.9%, thus, the volume of industrial production in 2013 decreased by 0.1% from the previous one. However, industrial production is an integrated indicator that includes the index of the extractive industry, manufacturing industry and electricity generation. The only area in which Russia has improved its performance this year is mining. It rose by 1.2%, while the remaining two indicators fell by 0.6% and 0.7%. Apparently, the increase in production was supposed to compensate for the decline in oil prices.

In the manufacturing industry, the peak of the fall fell on the share of industries involved in the production of machinery and equipment (tractors for agriculture and forestry, alternating current generators, central heating radiators, gas turbines).

On the whole, the decrease in the volume of industrial output is associated with a decrease in investment in fixed assets, both from internal sources and from external investment.

Investments in fixed assets for 11 months amounted to 99.3% of the level of the same indicator of the previous year, while for 11 months of 2012 the increase in investments was 108.2%.

Fig.4. Growth rate of investments in fixed assets, in %

Over the past 13 years, the decrease in the level of investment in fixed capital below the previous one occurred twice: in 2009 to 86.5% due to the economic crisis and this year. Although the decrease is not so significant, it is noteworthy that such phenomena are isolated cases, and it is not worth denying the likelihood of a deterioration in the economic situation in the future. 2013 may be a harbinger of crisis phenomena.

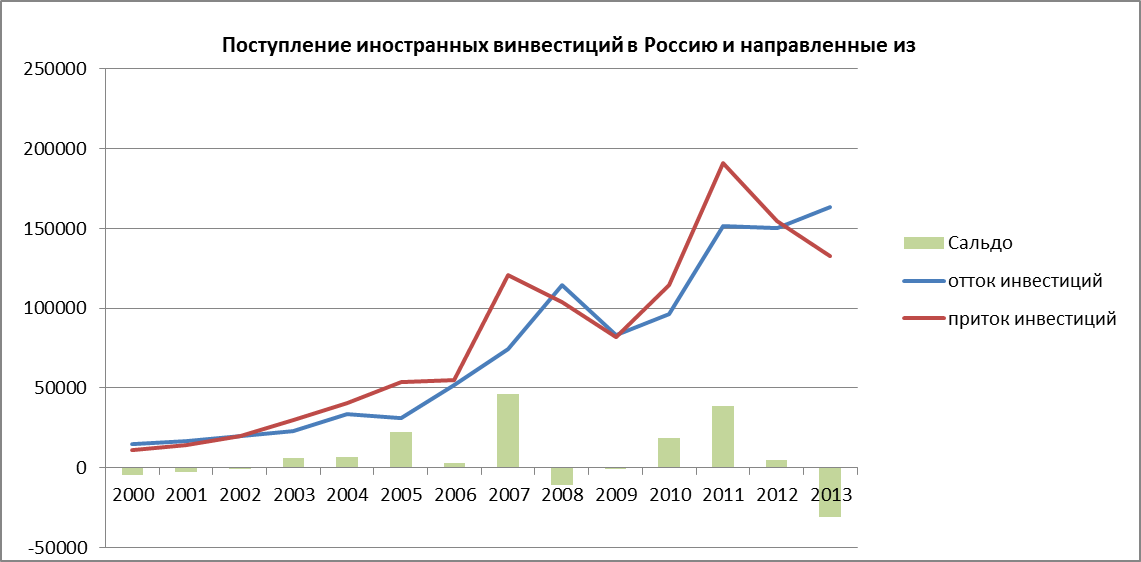

This year brought even greater disappointment to those who expected the active influence of foreign investment on the Russian economy. Although according to data for January-September 2013. to the Russian economy received $ 132.4 billion. foreign investments, which is 15.7% more than in January-September 2012; . The tough policy of the Central Bank towards the banking sector has led to a sharp outflow of foreign investment. During the first 9 months of 2013, more investments were taken out of Russia than were received. The total negative balance amounted to $30,873 million. If the trend continues, this figure will reach $41,164 million.

Fig.5. The flow of foreign investment from and to Russia, $ million

In the structure of foreign investments accumulated in Russia, 66.3% are other investments made on a repayable basis (credits), 32.3% are direct investments and 1.4% are portfolio investments. In investments accumulated abroad from Russia, more than 70% is occupied by direct investments.

Fig.6. Structure of accumulated foreign investments

Fig.7. Structure of investments taken out of Russia in foreign enterprises

Compared to 2012, the share of investments received in the form of a loan increased, while the share of other investments decreased. It is direct investment that is important for the country's economy. But, despite numerous calls from the authorities to create a favorable investment climate, it was not possible to attract direct investment, as a result, domestic companies are forced to resort to loans in the foreign market, which increases corporate debt in the country's total debt. Russia's main creditors are Luxembourg, the Netherlands, China, Cyprus, Great Britain, and Ireland.

Fig.8. Share of loans by countries that provided loans in the total volume of loans received (other investments in the structure of investments), in %

Rice. 9. Accumulated investments in Russia by countries (in % of the total investments of each country)

Foreign investments in the Russian economy serve as an indicator of business confidence in the government, but investments are different from investments: in the form of loans, they do not have an unambiguously positive impact on the economy, but to some extent pose a threat to national sovereignty and stimulate the creation of gray money laundering schemes.

In May decrees, Putin set the task of improving Russia's rating in Doing Business (reflects the ease of doing business in countries around the world). The task was completed - the country rose from 112th to 92nd line. All this was done in order to attract foreign investment. However, 2013 surpassed even the worst performance of 2008, when the flight of foreign investment was associated with the global crisis. In the first 9 months of this year, $30 billion left Russia. Offshore companies - the Virgin Islands, Cyprus, the Netherlands, Luxembourg - became the key recipients of the money. In other words, the problem of attracting foreign investment was approached from the wrong side, there are more significant factors than a simple improvement in the country's rating.

In general, this year was successful only for such an industry as agriculture. At a press conference on December 19, the President praised the progress in agriculture: “the index of agricultural production is 6.8%. It should be noted that agriculture, rural workers, of course, seriously helped the economy as a whole, because last year, as you know, there was a minus, almost 5%, this year - plus 6.8%. Against the backdrop of well-known difficulties in the industrial sector, agriculture, of course, pulls out the total GDP. Indeed, in the current year, agriculture has significantly improved the overall indicator of GDP, such results, according to the Minister of Economic Development, the country will not be able to expect next year.

In 2013, the inflation rate also decreased (6.3%), the unemployment rate did not change (5.5%). Last year, inflation fell to 6.6%, this year, according to initial forecasts, it should have been 6%, but in general, as in other areas, this result turned out to be worse than expected. The unemployment rate is expected to be at the level of the previous year - 5.5% (as of November 2013 - 5.4%), however, the Minister of Economic Development A. Ulyukaev at the Joint Meeting of the State Council and the Commission for Monitoring the Achievement of the Country's Development Targets on December 23 stated that in the future, there may be trends towards an increase in unemployment.

Russia's foreign trade activity also shows signs of stagnation: in the current year, the turnover has declined with a decrease in exports and an increase in imports. January-October 2013 Russia's foreign trade turnover, according to the Bank of Russia, amounted to $706.7 billion (99.9% compared to January-October 2012), including export - $426.7 billion (98.2%), import - $280 .0 billion (102.5%). In other words, the growth in consumer demand this year, largely due to credit inflation, stimulated not domestic production, but imports.

In general, in 2013, the share of fuel and energy resources in exports increased for the next year in a row (from 70.3% to 70.7%), the share of machinery and equipment increased by 0.1%, but at the same time, the shares of such groups as chemical industry, metals and metal products, foodstuffs and agriculture.

Fig.11. Structure of Russian exports, 1995 and 2013, in %

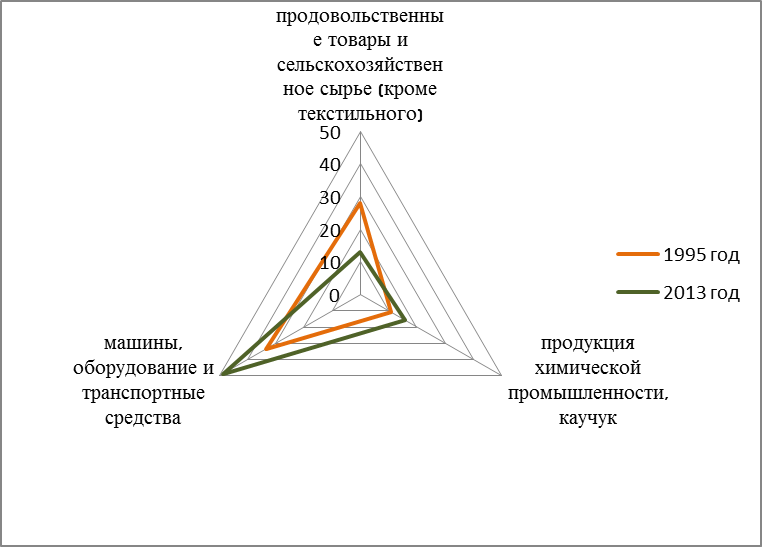

In imports, the share of such expenditure items as the purchase of food and chemical industry products increased, while the share of machinery and equipment decreased. These trends for Russian foreign trade turnover are natural, they once again testify to the active exploitation of the raw material model and the unwillingness in practice to move away from it in the direction of a more efficient economy.

Fig.12. Structure of Russian imports, 1995 and 2013, in %

This year, like the previous one, struck the country with an increase in the payment of the central apparatus of ministries. It would seem that there is nothing surprising, wages should rise, but why is the wage in the country growing by 11% (in real terms, it was lowered from 6% to 5.6%), and for officials by 67.7%. Before the presidential elections, the salary in the Presidential Administration was 3.9 times higher than the national average, but this year it is 5.6 times higher. In October 2013, the average salary without allowances in the Presidential Administration was 190,097 rubles. (167% of the previous year), in the Government Office - 184,783 rubles. (172% of the previous year), in the Federation Council - 96,481 rubles. (136.2% of the previous year), in the State Duma - 84,330 rubles. (136.1% of the previous year).

Fig.13. Dynamics of wage growth by authorities and on average across the country, 2008-2013 (according to Rosstat, data for the 3rd quarter of 2013), in rubles

The salaries of senior management are growing regardless of the effectiveness of public administration, as if what happens in the country is not responsible for specific individuals, but for random circumstances.

Natural population growth

According to the results of 9 months, Russia was able to achieve natural population growth for the first time since 1992. In the first half of the year, the decline continued, for 9 months the population growth amounted to 5109 people.

Natural growth is still observed only in four federal districts, of which the North Caucasian Federal District remains the absolute leader.

Fig.14. Natural population growth by districts, for 9 months of 2013, pers.

The top ten regions with the highest natural population growth include: Islamic republics, while the republics of the North Caucasus (Dagestan, Chechnya, Ingushetia) have the best indicators, national republics with Buddhist and shamanistic beliefs (Yakutia, Buryatia, Tyva), oil regions with high standard of living (Tyumen region, including the Khanty-Mansiysk and Yamalo-Nenets Autonomous District) and the center of attraction of the labor force - Moscow. Despite the fact that this year the natural increase is already in In 43 constituent entities, in 32 the indicators worsened: either the growth slowed down, or the population decline intensified. Gradually, the consequences of the demographic crisis of the 1990s begin to affect. The state-forming Russian people for 9 months of this year decreased by 57,670 people, which is significantly less than in previous years (in 2012 - 92,259, in 2011 - 186,616). The reduction in the number of Russians in a year can reach 76,000 people.

In terms of the birth rate, Russia has improved its position compared to 2012, but the negative trends of the 1990s are beginning to take effect, that is, population growth is expected to slow in the coming years. The loss of Russians is decreasing, but still remains very high.

The following important events in the economy took place this year:

Reducing official development forecasts

Forecasts for 2013 have changed several times: in December 2012, the expected GDP growth rate was reduced from 3.7% to 3.6%, with a second decrease in April from 3.6% to 2.4%, in August a new forecast was at the level of 1.8%, in December - 1.4%. The country began to develop according to a conservative scenario, entered into a "growth pause". Forecasts for subsequent years are also worsened: for 2014 - to 2.5% from 3.0%, for 2015 - to 2.8% from 3.1%. The Ministry of Economic Development expects stagnation in the economy in 2014 as well. Andrey Klepach, deputy head of the Ministry of Economic Development, called the outgoing year a year of missed opportunities. In order to reach growth, the economy needs cardinal and strong-willed decisions, however, apparently, the authorities will prefer calm stability, continuing to focus on the raw material model.

Recognition of internal problems in the economy

Back in his 2012 address, the President stated that "the reserves of the raw material model have been exhausted, while the interests of Russia's development require an annual growth of at least 5-6 percent of GDP in the next decade." In this year's message, for the first time, it was officially recognized that problems in the economy do not come from crisis phenomena in the global economy, but "are not of an external, but of an internal nature", primarily related to labor productivity, which lags behind the leading countries by two or three times. Let me remind you that the increase in labor productivity by 1.5 times compared to the level of 2011 by 2018 is laid down in the May decree of the President "On the long-term state economic policy." In the opinion of the authorities, the factors for the development of labor productivity should be the high quality of vocational education and a flexible labor market, a favorable investment climate and modern technologies. The transition to a bachelor's degree system that graduates people without a specialty, the dominance of non-profit universities that issue diplomas of higher education for a margin, will obviously not be able to provide a high quality of education; the tightening of the policy of the Central Bank with complete unpredictability does not create a favorable investment climate. As a result, some goals are proclaimed again, and the implementation tools clearly correspond to others.

Unfulfilled May Decrees of the President

Upon taking office as President, Putin signed a number of decrees, the implementation of which became a priority in public administration. For a year and a half of their implementation, there were no significant achievements, moreover, Medvedev admitted that the implementation of the May presidential decrees is impossible. At the Joint Meeting of the State Council and the Commission for Monitoring the Achievement of Development Targets, the only result of the implementation was the increase in wages in the field of education. But even the announced figures for the average wages of educational workers bear little resemblance to the real ones. They did not refuse to execute the decrees, the President scolded the officials for their improper work and threatened to take decisive measures in case of non-execution of his decrees.

Implementation of a course to boost lending

The Address of the President of 2012 indicates the need to create conditions for affordable lending. The result of this policy was the accelerated growth of the consumer lending sector. Speaking at the forum of the All-Russian Popular Front (ONF), the President of Russia called the level of debt load of Russians high, however, according to Putin, it is not critical for the Russian financial system. At that time, the volume of consumer loans reached 9 trillion rubles, that is, 14% of GDP. Another thing remains surprising: if the level is high, but not critical, then what should be done - take steps to resolve the situation or bring the level to critical? At the end of December, the President signed the law “On consumer credit (loan)”: it limits the cost of consumer credit and provides an opportunity to completely or partially refuse it. As a result, the loan will become even cheaper, which, on the one hand, is good given the immoderate interest rates, but on the other hand, cheaper loans will lead to an increase in lending to individuals, which means that in the near future the level of debt will definitely reach its critical level, and only then will the government dare solve this problem.

Tightening banking regulation

The Central Bank has taken targeted measures to rehabilitate the banking market. On the one hand, they are needed, as they are aimed at ridding the sector of unscrupulous players, but like any unpopular measures, they have not been slow to negatively affect the investment climate in the country and the level of trust in the government.

2013 set the development vector for the next year:

Deoffshorization of the economy

The problem of the export of capital through offshore for Russia has long been one of the central. Huge revenues from the export of energy resources are systematically exported by the private sector, the country serves the needs of the outside world, limiting itself in consumption. According to the Central Bank, the total volume of capital export for 20 years amounted to $ 436.3 billion. This year, $ 48.1 billion, $ 48 is expected. .8 billion

The other sector (individuals and corporations) became the main exporters of capital. For 20 years, only 2006 and 2007 were marked by a positive balance of capital movement. A sharp outflow occurred in 2008, and at the moment, the annual volume of capital outflow exceeds that of the 1990s. In the new Address, the President again spoke on the deoffshorization of the economy, suggesting certain steps to combat this. The question remains unanswered: why has no one been concerned about this problem before? Why do we have the volume of exported capital over 20 years (according to the Central Bank, and according to foreign sources, twice as much was exported from Russia in 10 years than the Central Bank quotes in 20 years) are practically equal to the volume of accumulated gold and foreign exchange reserves?

Printing out the FNB

Since 2008, when the Fund was established to become part of a sustainable mechanism for providing pensions to citizens, the fund's funds have not been invested. This year, after the completion of large-scale Olympic construction projects, the authorities decided to open a fund for investing in large infrastructure projects. Soon the President promised to provide a loan to Ukraine from the NWF. As a result, the decision to print the fund has been made, the decision to invest is in the plans, the money has not yet been allocated, but Ukraine, which initially should not have received these funds from the fund at all (its securities belong to countries with a high level of risk, in such securities the Fund did not invest until the moment when the political decision did not enter into dissonance with the normative fixing) the loan has already been promised.

Declared a national priorityXXIcentury Siberia and the Far East

The ambitious plan of the President can be considered "the rise of Siberia and the Far East", this goal is proclaimed "a national priority for the entire XXI century." The development of the Far East corresponds to the country's foreign policy vector - orientation towards active participation in APEC, integrative interaction with the countries of East and Southeast Asia. In other words, if Kaliningrad is our "showcase" in Europe, then the Far East is called upon to fulfill this mission in Asia. However, there are serious doubts that such a resource-rich region as the Far East will be able to effectively develop non-resource production, and there is also concern that the country's economy is unlikely to be able to endure these projects.

Summing up the year, I would like to note that the year as a whole was unsuccessful: the worst forecasts of analysts were confirmed, the economy is in stagnation and awaits reforms, but the worst thing is that the government does not see the path of these reforms, is removed from problems with lengthy speeches with general formulations, and in generally represents fatigue rather than readiness for a real real economic miracle. The vocabulary of the leadership is dominated by the words innovation, modernization, technology and efficiency, in practice the strategy of strengthening positions through oil and gas diplomacy is being implemented, and they still have a glimmer of hope that for now it is possible to do without reforms, that the raw material model will allow the country to stay afloat for several years. But do not be misled by the "extreme delusion".